Should I Make a Claim on My Homeowners Insurance?

Something happened about my home a few weeks ago that I had never given much thought about: my home had been hit by lightning back on August 22. A quick but strong storm descended on the SouthCoast, and before we knew it, a bolt of lightning struck our sprinkler system.

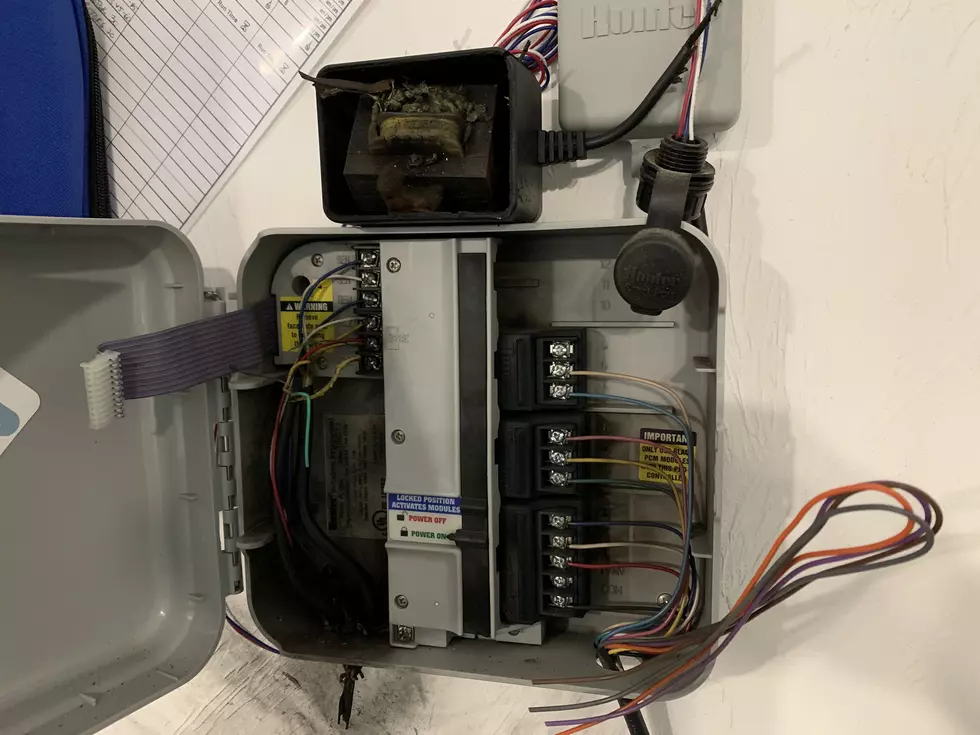

The obvious damage was to my sprinkler system and the control box inside, but there were a bunch of things that were knocked off after the storm, and some damage to our electrical box and breakers down in our cellar.

Luckily, after I had an electrician check out the damage, it wasn't as bad as I initially feared. While the sprinkler system was definitely fried to a crisp from the direct hit, our electrical panel was spared major damage. The electrician thought maybe a $400-$500 job.

Here's my dilemma: I'm pretty sure that my homeowners insurance deductible is $1,000. The cost of repairing the sprinkler system will be roughly $1,500. Add that to the cost of the electrical repairs and we are looking at about $2,000 total. Take away the $1,000 deductible and it has me wondering if it is worth putting in a claim for $1,000?

While I've never filed a homeowners insurance claim, I have heard that insurance companies can penalize you for filing a claim. That being said, I am wondering if it is worth the hassle and future cost of filing a claim. Could it end up costing me more than the $1,000 that the insurance company would send?

The other thing to consider is that lightning strikes can be tricky. A friend of mine had his house struck by lightning and he was still discovering damage over a year later.

I am at a loss as to what to do.

TIPS: Here's how you can prepare for power outages

More From WFHN-FM/FUN 107

![Fun Morning Show Attempts the Mariah Carey ‘High Note Vocal Run’ Challenge [VIDEO]](http://townsquare.media/site/519/files/2023/12/attachment-mc.jpg?w=980&q=75)

![Fall River Mother Suffering From Paresthesia Is Losing Hope [HOLIDAY WISH]](http://townsquare.media/site/519/files/2021/12/attachment-Untitled-design-28.jpg?w=980&q=75)