It’s Not Junk Mail, You Really Did Get a Check from Wells Fargo

I save my pile of mail for Sunday night like anyone else scared of opening their bills might do. This past Sunday, I sorted through my week's pile of stuff, separating my bills from junk mail, retail offers and the such. Then I got distracted and walked away.

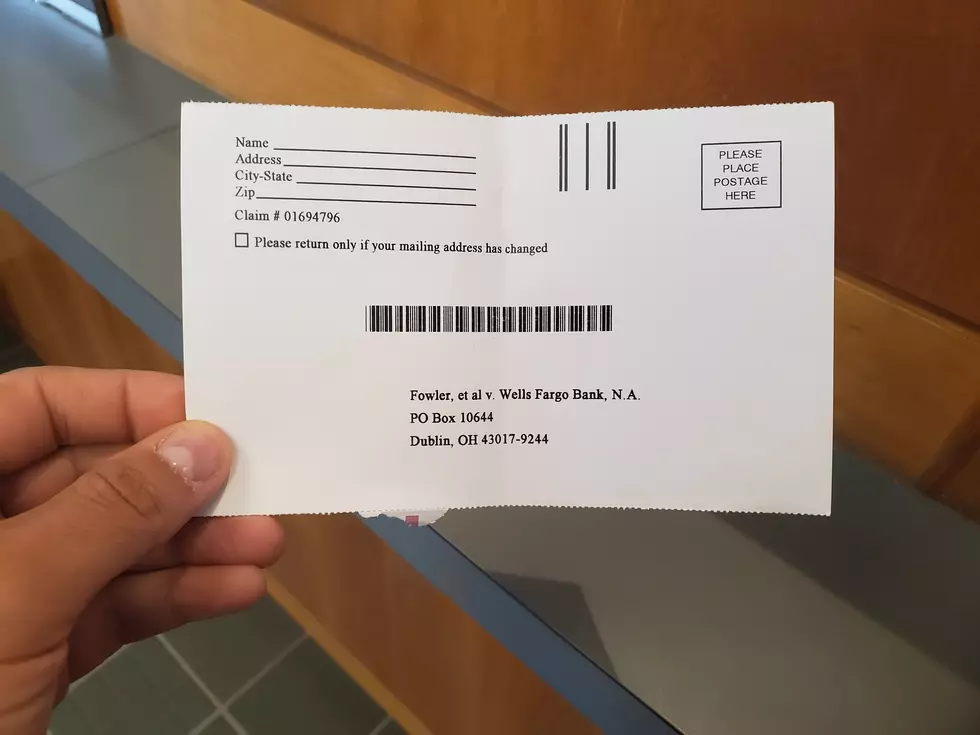

A few hours later I returned to my kitchen counter to tear up the aforementioned junk mail pile and for some reason decided to open this very particular piece of junk mail from Wells Fargo. I don't have any loans through Wells Fargo currently, so surely it was a clever piece of scam mail designed to get me back.

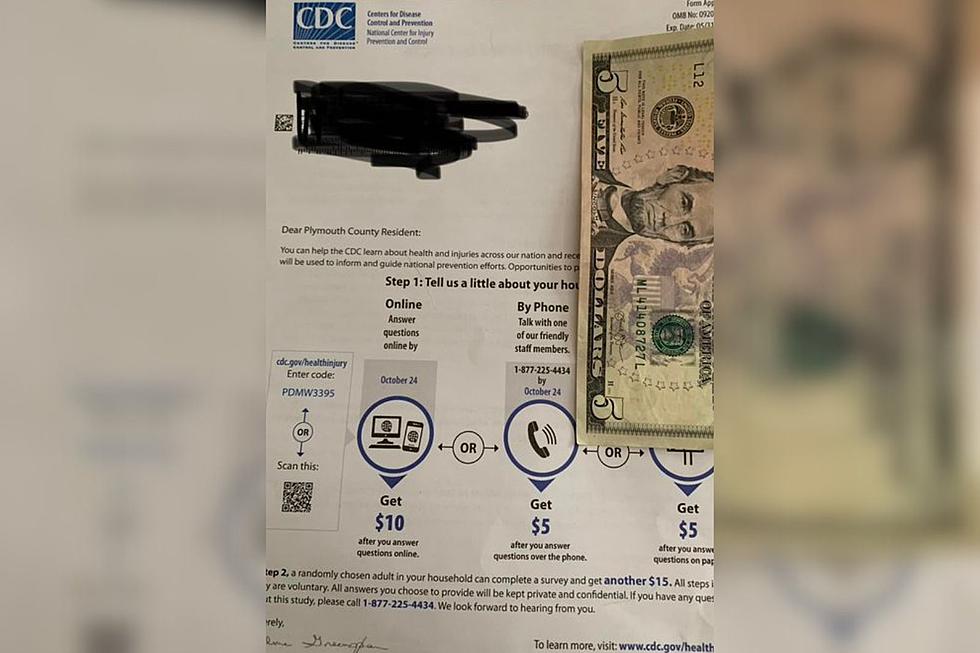

But surprise! This junk mail was NOT from Wells Fargo, but from Fowler, et al v. Wells Fargo Bank N.A. If you took out an FHA-insured loan that was originated beginning June 1, 1996 and ending January 20, 2015, your junk mail pile could include a settlement check. Even the bank teller who cashed this check agreed that the check looked kind of weird, especially since there was nowhere to sign.

According to FHASettelement.com, checks are getting sent out because of some shady business practices, outlined below.

IF YOU PREPAID AN FHA-INSURED LOAN WITH WELLS FARGO ON A DAY OTHER THAN THE FIRST OF THE MONTH, THE LOAN WAS ORIGINATED BEGINNING JUNE 1, 1996 AND ENDING JANUARY 20, 2015, AND YOU PAID OFF THE LOAN DURING THE APPLICABLE LIMITATIONS PERIOD, THEN THE PROPOSED SETTLEMENT OF A CLASS ACTION LAWSUIT MAY AFFECT YOUR RIGHTS.

Of course, this $30 million settlement had to get split up among quite a few people, so don't expect it to be a whopper. But if you're like me, $10 I didn't expect is better than $10 accidentally thrown in the trash.

More From WFHN-FM/FUN 107