Massachusetts Excise Tax Season Could Go Supersized

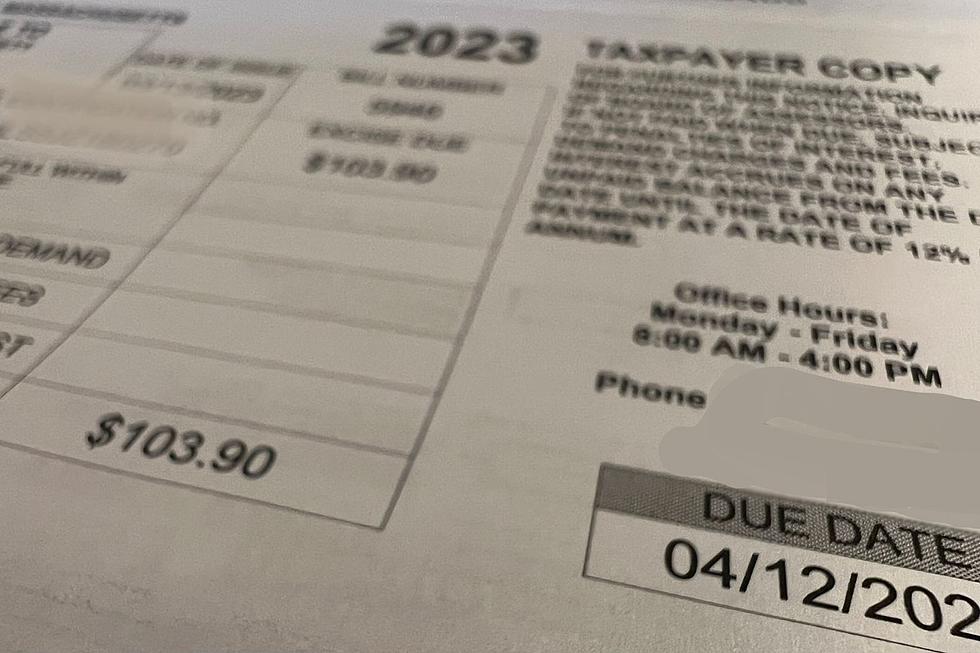

In Massachusetts, March is the time of year when we open the mailbox to greetings friendly excise tax bills from our cities and towns.

They're lovely and the timing on them couldn't be better.

For us, the timing usually works out that we get word about our tax refund one day, then the next we are facing the irritating excise tax bills.

The government giveth, and the government taketh away.

Not many states burden their citizens with an excise taxes on their automobiles, but Massachusetts is one of them. In perfect Massachusetts fashion, the state taxes our income, then charges us a sales tax when we buy a car. Then, they charge a tax every year in perpetuity for as long as we own that car. Imagine being taxed yearly for the simple privilege of owning an item in the Commonwealth of Massachusetts?

Massachusetts State Tax Or Local Tax?

It might make you feel better thinking that the excise taxes are used to make our roads, bridges and highways better and safer. Unfortunately, that's not exactly the case. While it is a state tax, the local cities and towns that collect the money, and the local governments are free to use the money however they see fit.

Massachusetts Excise Taxes May Soon Grow

Excise taxes have grown to include local municipal taxes on hotels, restaurants and, most recently, marijuana. If Governor Maura Healey has her way, every Massachusetts city and town will soon have the option of raising the excise tax across the board with increases in meals and lodging taxes and a 5% surcharge on your current excise tax bill.

The governor hopes these new taxes will help make up for the Covid relief money that has dried up.

"It’s also true that, as a state, we had several flush years with pandemic relief funding from the federal government," Healey said in her State of the Commonwealth address in January. "Now that’s gone away."

How Massachusetts Calculates Your Excise Tax

As far as vehicles go, the first step of calculating your excise tax bill is determining the manufacturer's list price in the year it was built. The first year that you own your car, you'll use 90% of your vehicle's list price as the value. You'll pay $25 for each $1,000 that the vehicle is worth.

For example, if you paid $10,000 for a current vehicle, you'll use $9,000 as the value of the vehicle in year one. That amounts to $225. In year two, you'd use $6,000 as the value of the vehicle, and your excise tax will drop to $150.

These figures, however, are using the current tax layout.

If the governor's tax increase bill is approved, the numbers will jump.

Items That Are Banned or Prohibited from Mailing in Massachusetts

Gallery Credit: Maddie Levine

Check Out the Richest Counties in Massachusetts

Gallery Credit: Maddie Levine

25 Times SouthCoasters Won $1 Million or More in the Massachusetts Lottery

Gallery Credit: Gazelle

More From WFHN-FM/FUN 107

![Overly-Excited Mom Drives Her Car Down the Stairs at Disney [PHOTOS]](http://townsquare.media/site/519/files/2020/08/Car-3.jpeg?w=980&q=75)