Michael Rock Gets Awkward Credit Card Offer

I'm not really a credit card guy. I'm a little old-school. If I can't afford to buy something with the cash that I have on my debit card or in my wallet, I feel like I usually shouldn't be buying it.

That's why I was surprised to receive a credit card in the mail yesterday. I could feel the credit card already in the envelope.

"Who ordered this," I thought.

I knew I didn't, and I was wondering why my wife would.

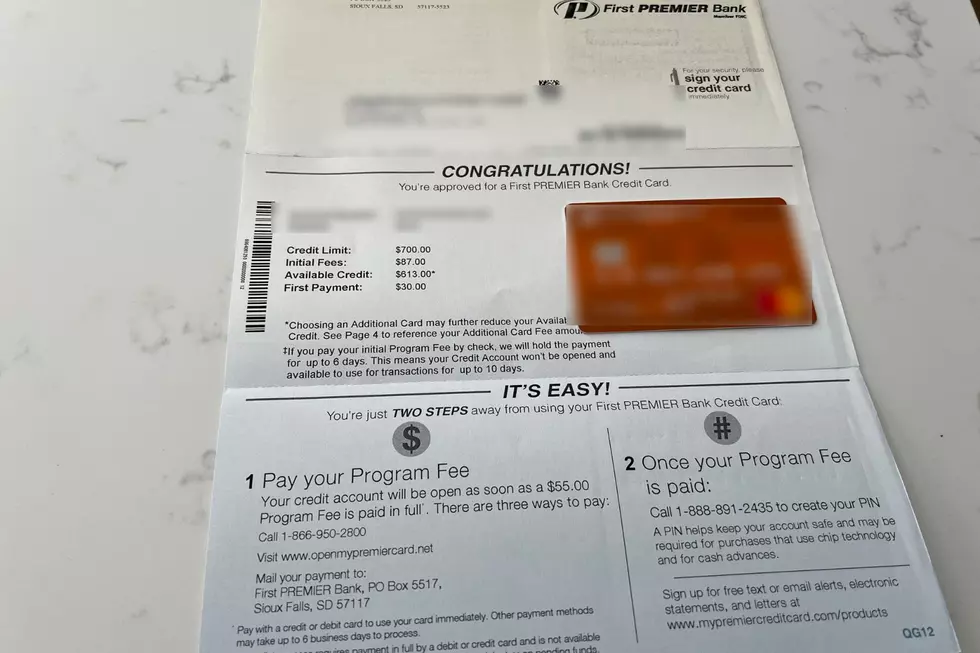

I opened the envelope and saw an orange credit card with my name on it.

"It's easy," said the letter. All I had to do was pay the program fee, which was $55, and my credit account would be activated as soon as the fee was paid in full.

That's not all. I'd also have to pay an $87 "initial fee," but don't worry because I could use my credit limit to cover those costs. The credit limit was a laughable $700, which would barely cover a couple of tanks of gas these days, never mind a couple of tanks of home heating oil.

After the"initial fee," read the letter, my available credit would be $613.

Here's the best part. You might be wondering what the annual percentage rate on this totally-not-shady-in-any-way credit card might be. Not 10%. Not 25%. The card had an interest rate of 36%.

I'm dead serious when I say I thought an interest rate that high was illegal. It seems predatory.

Oh, I almost forgot. There was also an annual fee of $79 and a monthly fee of $8 for the first year (which adds up to another $96 a year) and $10.40 per month after that (which adds up to $124.80 a year).

Naw, I'm good, thanks.

LOOK: Here are 25 ways you could start saving money today

Nine SouthCoast Restaurants We Miss That You Might Miss Too

More From WFHN-FM/FUN 107

![Dollars & Sense: Low Interest Credit Card for Back to School [SPONSORED]](http://townsquare.media/site/519/files/2018/08/RS9817_480784658.jpg?w=980&q=75)